- Transaction expected to combine Accelus and CHP Merger Corp., a leading healthcare-focused SPAC.

- The pro-forma enterprise value of the business combination would be approximately $482 million.

- Chris Walsh, Accelus CEO and Co-Founder, will become CEO of the combined company, Accelus. Mr. Walsh has 25 years of experience at leading spinal health companies, including Stryker and NuVasive.

- Joseph Swedish, Chairman of CHP Merger Corp., and seasoned industry executive Alex Lukianov will join the Board of Directors of the combined company. Mr. Swedish has decades of healthcare industry experience having served in positions at Anthem, Trinity Health, Centura and HCA Healthcare. Mr. Lukianov has over 35 years of leadership and entrepreneurial experience across several leading medical technology companies, including NuVasive, BackCare Group, Smith & Nephew and Medtronic.

PALM BEACH GARDENS, Fla. and SUMMIT, N.J., Nov. 15, 2021 (GLOBE NEWSWIRE) — Integrity Implants Inc. d/b/a Accelus (“Accelus”), a commercial stage medical technology company focused on accelerating the adoption of minimally invasive surgery (MIS) as the standard of care in spine, and CHP Merger Corp. (Nasdaq: CHPM), a special purpose acquisition company, or SPAC, formed by an affiliate of Concord Health Partners, today announced entry into a definitive business combination agreement. Upon the closing of the business combination, CHP Merger Corp. will be renamed Accelus. The business combination is expected to be completed in early 2022.

Company Overview

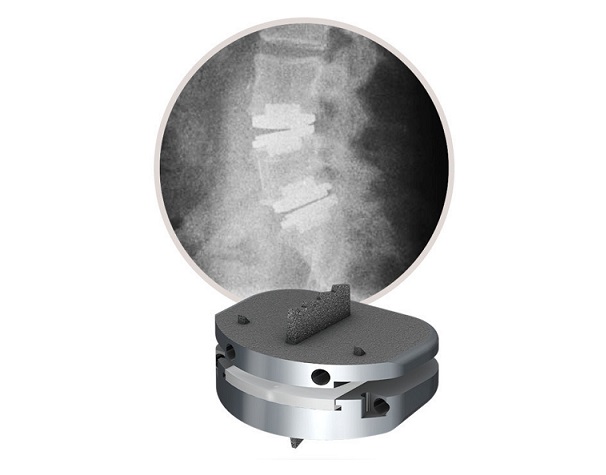

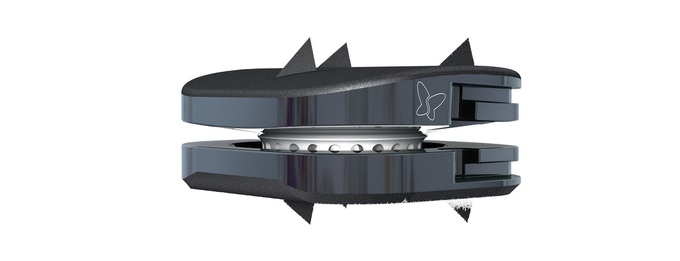

Based in Palm Beach Gardens, Florida, and established through the combination of Integrity Implants Inc. and Fusion Robotics, LLC, Accelus is a commercial stage medical technology company with a mission to accelerate the adoption of minimally invasive surgery as the standard of care in spine. With a portfolio of MIS spinal implants leveraging its proprietary Adaptive GeometryTM technology and a compact precision robotics platform, Accelus is focused on improving procedures and outcomes, creating favorable economics, and providing broad accessibility across end markets, including ambulatory surgery centers and internationally.

Management Comments

Chris Walsh, Chief Executive Officer and Co-Founder of Accelus, commented, “We believe our highly differentiated, high-margin product portfolio has the power to drive broad adoption of robotics and minimally invasive techniques in spinal care, both in hospitals and ASCs, by addressing critical constraints related to cost and efficiency. Our products can uniquely meet demand across broad market segments with adaptable solutions to cover each surgeon’s preferred approach and each healthcare facility’s space and budget limitations, embodying our principle of access without compromise. This transaction stands to significantly accelerate our commercial efforts and to transform spinal surgery with MIS approaches.”

Joseph Swedish, Chairman of CHP Merger Corp., said, “Since our inception, we have sought opportunities to partner with companies that are disruptors of the status quo through working to lower costs and expand access to quality healthcare. Accelus is not only a leader in this regard, but we are confident they are poised to become a leading innovator in the spinal health market. We’ve been so impressed with Chris and his team’s mission and sense of purpose, and we’re thrilled to partner with the entire Accelus team on their mission to redefine minimally invasive surgery as the new standard of care in spine.”

Transaction Overview

On November 14, 2021, CHP Merger Corp. entered into a definitive agreement to combine with Accelus. Upon closing of the business combination, the combined company will have an estimated pro-forma enterprise value of approximately $482 million.

The proposed transaction has been unanimously approved by the boards of directors of each of CHP Merger Corp. and Accelus and is subject to the approval of the stockholders of CHP Merger Corp. and Accelus, and the satisfaction or waiver of other customary conditions, including a registration statement on Form S-4 being declared effective by the U.S. Securities and Exchange Commission (the “SEC”). The proposed transaction is expected to close in early 2022.

Additional information about the proposed transaction, including a copy of the business combination agreement and an investor presentation, will be provided in a Current Report on Form 8-K to be filed today by CHP Merger Corp. with the SEC, which will be available at www.sec.gov.

Advisors

Piper Sandler is serving as exclusive financial advisor to Accelus. Cadwalader, Wickersham & Taft LLP is serving as legal advisor to Accelus.

Credit Suisse is serving as financial and capital markets advisor, and J.P. Morgan Securities LLC is serving as a capital markets advisor to CHP Merger Corp. Ropes & Gray LLP is serving as legal advisor to CHP Merger Corp.

Management Presentation and Webcast Details

A webcast of the corporate presentation and associated materials is available on Deal Roadshow:

Deal Roadshow Investor Login Details

URL: https://dealroadshow.com

Direct Link: https://dealroadshow.com/e/ACCELUS2021

Entry Code: ACCELUS2021

About Accelus

Accelus is committed to accelerating minimally invasive spine surgery through its enabling technology with broad accessibility to previously underserved markets. Established through the combination of Integrity Implants and Fusion Robotics, Accelus is focused on providing its proprietary Adaptive GeometryTM technology with pragmatic and economical navigation and robotic solutions with broad clinical use in spine surgery. Learn more at www.accelusinc.com.

About CHP Merger Corp.

CHP Merger Corp. is a Special Purpose Acquisition Vehicle formed by an affiliate of Concord Health Partners (“Concord”). Concord Health Partners is a healthcare private equity firm that invests in growth stage companies with innovative technologies that advance healthcare through lower costs, higher quality and expanded access to care.

Concord Health Partners has a strategic partnership with the American Hospital Association (the “AHA”), a national health care industry group comprised of nearly 5,000 members. The AHA has invested in the sponsor alongside Concord Health Partners and will leverage its marketing capabilities, thought leadership and network of relationships to fast-track Accelus’s growth and accelerate its market adoption.

Important Information about the Business Combination and Where to Find It

In connection with the proposed business combination (the “Business Combination”), CHP Merger Corp. (“CHP”) intends to file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “Registration Statement”), which will include a preliminary proxy statement/prospectus and a definitive proxy statement/prospectus, and certain other related documents, which will be both the proxy statement to be distributed to holders of CHP’s ordinary shares in connection with CHP’s solicitation of proxies for the vote by CHP’s shareholders with respect to the Business Combination and other matters as may be described in the Registration Statement, as well as the prospectus relating to the offer and sale of the securities of CHP to be issued in the Business Combination. CHP’s shareholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus included in the Registration Statement and the amendments thereto and the definitive proxy statement/prospectus, as well as other documents filed with the SEC in connection with the proposed Business Combination, as these materials will contain important information about the parties to the Business Combination Agreement, CHP and the proposed Business Combination. After the Registration Statement is declared effective, the definitive proxy statement/prospectus and other relevant materials for the proposed Business Combination will be mailed to shareholders of CHP as of a record date to be established for voting on the proposed Business Combination and other matters as may be described in the Registration Statement. Shareholders will be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus, and other documents filed with the SEC that will be incorporated by reference therein, without charge, once available, at the SEC’s web site at www.sec.gov.

Participants in the Solicitation

CHP and its directors and executive officers may be deemed participants in the solicitation of proxies from CHP’s shareholders with respect to the Business Combination. You can find information about CHP’s directors and executive officers and their ownership of CHP’s securities in CHP’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on March 30, 2021, and is available free of charge at the SEC’s web site at www.sec.gov. Additional information regarding the interests of such participants will be contained in the Registration Statement when available.

Accelus and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of CHP in connection with the Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination will be contained in the Registration Statement when available.

Forward-Looking Statements

No representations or warranties are made or implied with respect to the information contained herein. This press release contains forward-looking statements with respect to CHP and Accelus. These forward-looking statements, by their nature, require us to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements, including without limitation the successful and timely completion of the proposed business combination. Forward-looking statements are not guarantees of performance. These forward-looking statements, including financial outlooks and strategies or deliverables stated herein, may involve, but are not limited to, comments with respect to effects of the proposed business combination, CHP business or financial objectives, its strategies or future actions, its projections, targets, expectations for financial condition or outlook for operations. Words such as “may,” “will”, “would”, “could”, “expect”, “believe”, “plan”, “anticipate”, “intend”, “estimate”, “continue”, or the negative or comparable terminology, as well as terms usually used in the future and conditional, are intended to identify forward-looking statements. Information contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including perceptions of historical trends, current conditions and expected future developments, as well as other considerations that are believed to be appropriate in the circumstances. These assumptions are considered to be reasonable based on currently available information, but the reader is cautioned that these assumptions regarding future events, many of which are beyond its control, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect our business. The forward-looking information set forth herein reflects expectations as of the date hereof and is subject to change thereafter. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Undue reliance should not be placed on forward-looking statements. The forward-looking statements contained in this press release are expressly qualified by this cautionary statement. This press release is not intended to form the basis of any investment decision and there can be no assurance that any transaction will be undertaken or completed in whole or in part. The delivery of this press release shall not be taken as any form of commitment on the part of Accelus, CHP or their respective shareholders to proceed with any transaction, and no offers will subject Accelus, CHP or their respective shareholders to any contractual obligations before definitive documentation has been executed. We reserve the right at any time without prior notice and without any liability to (i) negotiate with one or more prospective investors in accordance with any timetable and on any terms that we may decide, (ii) provide different information or access to information to different prospective investors, (iii) enter into definitive documentation and (iv) terminate the process, including any negotiations with any prospective investor without giving any reasons therefor. This press release does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of CHP, Accelus, or any of their respective affiliates.

No Offer or Solicitation

This press release shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination. This press release shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended.

Contacts

CHP Merger Corp. Investor Contact:

James Olsen

info@concordhp.com

Accelus Investor Contact:

Brian Johnston

Gilmartin Group

ir@accelusinc.com