CARLSBAD, Calif., March 22, 2021 (GLOBE NEWSWIRE) — SeaSpine Holdings Corporation (NASDAQ: SPNE), a global medical technology company focused on surgical solutions for the treatment of spinal disorders, announced today that it has entered into an agreement to acquire all of the issued and outstanding shares of 7D Surgical, Inc., a privately-held, Toronto-based company, in a cash and stock deal valued at $110 million, subject to customary adjustments. In February 2020, SeaSpine announced that it had entered into a strategic alliance agreement to distribute 7D Surgical’s flagship navigational system founded on its machine-vision, image-guided surgery platform.

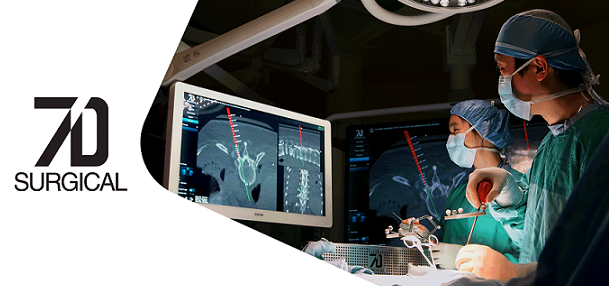

7D Surgical, a pioneer in the image-guided surgery market, has developed and commercialized advanced machine-vision-based registration algorithms to improve surgical workflow and patient care, currently with applications in spine and cranial surgeries. Its flagship system, founded on its machine-vision, image-guided surgery platform, reduces radiation exposure by eliminating intra-operative CT (computed tomography) and fluoroscopy for purposes of registration, both of which commonly are used for patient registration with traditional navigational systems. Notably, the 7D system is able to complete the entire patient registration process in less than 30 seconds, compared to 30 minutes typical with traditional systems.

Keith C. Valentine, SeaSpine President and Chief Executive Officer, said: “This combination of our innovative cultures will allow us to expand and stretch our clinical value by fully encompassing the patient experience from the onset of surgical planning through the end of treatment and recovery. We believe that participation in the patient’s complete continuum of care, coupled with an industry leading safety profile for the surgeon, the surgical support team, and the patient, will accelerate our market-share taking strategy. As we know, surgeons can reach their occupational limit of radiation in as little as 10 years. We believe the 7D platform, combined with our now-comprehensive spinal implant and orthobiologics portfolios, will lead the way in advancing spine surgery, while making everyone safer in the surgical environment.”

Beau Standish, 7D Surgical Chief Executive Officer, said: “We partnered with SeaSpine in early 2020 because of a shared commitment to constant innovation, and we already have seen the benefits of our collective efforts to align SeaSpine’s spinal implants and orthobiologics products more closely with our technology platform and our surgeon-centric focus on improving surgical workflows. I believe this transaction greatly expands our commercial reach by providing healthcare providers with a complete surgical solution and capital-efficient means of acquiring a 7D system, and we are thrilled to be a part of SeaSpine’s innovative approach to improving patient outcomes.”

John Bostjancic, SeaSpine Senior Vice President, Chief Financial Officer, said: “Once closed, the transaction is expected to contribute to revenue through the addition of the 7D customer base, as well as the opportunity to place additional systems on a capital-efficient basis by allowing hospitals to acquire them over time through the purchase of SeaSpine’s spinal implants and orthobiologics. We believe 7D provides an opportunity to gain access to new accounts and increase our presence in existing accounts, both by having access to this novel technology and our ability to place systems at little or no upfront cost to the hospital through SeaSpine product earn-outs. The transaction also increases our flexibility with respect to hospital purchase commitments. We expect the acquisition to be immediately accretive to revenue and revenue growth.”

Transaction Terms

The transaction will be effected by way of an arrangement under the Business Corporations Act (Ontario). 7D Surgical shareholders will receive an aggregate of 4,289,848 shares of SeaSpine stock, equivalent to $82.5 million based on the volume-weighted price between March 8, 2021 and March 19, 2021, and an aggregate of $27.5 million in cash. After giving effect to the transaction, 7D shareholders will hold approximately 13% of issued and outstanding SeaSpine shares (based on shares outstanding as of March 19, 2021). SeaSpine expects to finance the cash portion of the acquisition consideration from the more than $88 million of cash currently on-hand, which includes $20 million of recent borrowings under its $30 million credit facility.

The transaction is subject to, among other things, the approval of 7D shareholders at a special meeting expected to be convened by 7D, receipt of required regulatory and court approvals and other customary closing conditions. SeaSpine shareholder approval is not required. Additional details of the transaction will be provided to 7D shareholders in an information circular to be delivered in connection with the special meeting. It is currently anticipated that, subject to receipt of all regulatory, court, shareholder and other approvals, the transaction will be completed in the second quarter of 2021.

The transaction was unanimously approved by the board of directors of each of SeaSpine and 7D Surgical.

Financial Outlook

SeaSpine will provide additional information on the expected financial impacts of the transaction after it closes.

Webcast

The Company will host a webcast on Tuesday, March 23 at 5:45 a.m. PT / 8:45 a.m. ET to discuss this transaction. The webcast and presentation materials are available at https://wsw.com/webcast/cc/spne4/1437948.

An archived edition of the webcast and the presentation materials will be available in the Investor Relations section of SeaSpine’s corporate website at www.seaspine.com.

About SeaSpine

SeaSpine (www.seaspine.com) is a global medical technology company focused on the design, development and commercialization of surgical solutions for the treatment of patients suffering from spinal disorders. SeaSpine has a comprehensive portfolio of orthobiologics and spinal implants solutions to meet the varying combinations of products that neurosurgeons and orthopedic spine surgeons need to perform fusion procedures on the lumbar, thoracic and cervical spine. SeaSpine’s orthobiologics products consist of a broad range of advanced and traditional bone graft substitutes that are designed to improve bone fusion rates following a wide range of orthopedic surgeries, including spine, hip, and extremities procedures. SeaSpine’s spinal implants portfolio consists of an extensive line of products to facilitate spinal fusion in degenerative, minimally invasive surgery (MIS), and complex spinal deformity procedures. Expertise in both orthobiologic sciences and spinal implants product development allows SeaSpine to offer its surgeon customers a differentiated portfolio and a complete solution to meet their patients’ fusion requirements. SeaSpine currently markets its products in the United States and in approximately 30 countries worldwide through a committed network of increasingly exclusive distribution partners.

Forward-Looking Statements

SeaSpine cautions you that statements in this news release that are not a description of historical facts are forward-looking statements based on the Company’s current expectations and assumptions. Such forward-looking statements include, but are not limited to, statements relating to: the plans, objectives, intentions, expectations (financial or otherwise) and benefits with respect to the proposed acquisition of 7D Surgical; expectation of the acquisition to be immediately accretive to revenue and revenue growth; and that the transaction will be completed in the second quarter of 2021. There can be no assurance that the transaction will occur, or that it will occur on the terms and conditions contemplated in this news release. The transaction could be modified, restructured or terminated. Among the factors that could cause or contribute to material differences between the Company’s actual results and the expectations indicated by forward-looking statements are risks and uncertainties that include, but are not limited to: assumptions as to the timing and ability to complete the acquisition, including the time required to prepare and mail 7D Surgical shareholder meeting materials; the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary regulatory, court and shareholder approvals; the disruption to the functioning of the regulatory bodies that provide the necessary regulatory and court approvals or any ancillary disruption, anticipated or otherwise, due to the outbreak of the novel coronavirus (COVID-19); the ability of the parties to satisfy, in a timely manner, the conditions to closing; the ability of the Company to successfully integrate the 7D Surgical business and other expectations and assumptions concerning the transaction; general economic and business conditions in the markets in which the parties do business, both in the U.S. and outside the U.S.; and other risks and uncertainties more fully described in the Company’s news releases and periodic filings with the Securities and Exchange Commission. The Company’s public filings with the Securities and Exchange Commission are available at www.sec.gov.

You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date when made. SeaSpine does not intend to revise or update any forward-looking statement in this news release to reflect events or circumstances arising after the date hereof, except as may be required by law.

Investor Relations Contact

Leigh Salvo

(415) 937-5402

ir@seaspine.com