Spinal implant startup is the first to receive funding from ACF Investors’ Delta Fund, thanks to the backing of expert medtech angel investor

24th February, 2021 – Axis Spine Technologies Ltd (AST) has raised £2.2m in a funding round led by ACF Investors, with follow-on investment from Mercia’s EIS funds. Mercia was the first investor when Axis was founded by Jon Acros in 2017. This is the first investment from ACF Investors’ new Delta Fund, a fast-track investment fund designed for high-potential UK businesses that have been backed by a syndicate of angel investors with deep sector knowledge.

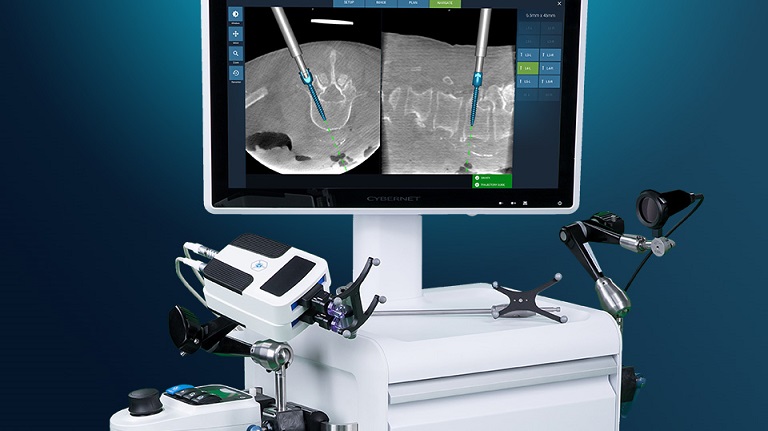

Axis is developing the next generation of Anterior Spinal Implant technology which provides surgeons with increased correction and alignment options. Its modular devices are inserted with less force than conventional implants to reduce the risks of structural damage which can lead to subsidence, an under-reported and recognised complication.

The angel syndicate is led by Simon Cartmell, who has more than 40 years pharmaceutical, biotech and medtech experience. He brings specialised expertise in orthopaedic technologies to his new role on AST’s board. Previously he was CEO of Apatech, an orthobiologics company specialising in bone grafting and spine repair, which was acquired by Baxter Healthcare in 2010 and subsequent Non-Executive Director appointments with several other companies in related fields.

The Axis-ALIF, Axis Spine’s first implant system, has already attracted commercial interest in pre-release activities and will soon demonstrate its clinical benefits with several top US spine surgeons that are ready to start using the device. The funding will be used to support the launch of the new device in the USA, and also to progress developments of Oblique, Lateral cage implants, as well as a highly differentiated access system.

Jon Arcos, Founder and CEO of Axis, comments: “In 2021 we will take a big step forward in our mission to help surgeons improve the spinal care they provide to their patients. Our products will enable them to achieve superior correction and to maintain this correction more reliably than with the devices available today. Simon Cartmell’s addition to the board means we can draw on his experience and deep sector knowledge to help take Axis to the next level. We are very pleased to be the first investment from ACF Investors’ Delta Fund and to have the continued support of Mercia and our independent angel investors as we demonstrate the benefits of modular implants and expand the Axis product range.”

Tim Mills, Managing Partner at ACF Investors, comments: “We believe that the active involvement of stand-out angel investors is one of the largest contributing factors to the success of an early-stage company. Having Simon on board and a proposition as strong as Axis Spine’s technology makes this investment the perfect fit for The Delta Fund. We are excited to see where the team takes the company by opening up new markets and expanding their product suite, which will help improve outcomes for surgeons and patients alike.”

Simon Cartmell, Managing Director of Route2Advisors said: “I am really pleased to work with ACF for a second time to bring their support to Axis Spine. It is a great example of the UK ecosystem supporting fantastic entrepreneur-led medtech companies and I am delighted to assist Jon and the Axis team take their superior products to market and to build out the underlying platform.”

Peter Dines, COO of Mercia said: “Axis is now funded to bring the Axis-ALIF device to the lucrative US market and generate momentum. Jon and the team have an exciting year ahead with a new product that offers several meaningful clinical benefits to surgeons and their patients. We are proud to have been the first investor at the formation of Axis Spine and we will continue to support them during this critical year of growth.

About Axis Spine Technologies

Founded in 2017, Axis Spine Technologies is a UK based medical device company focused on advancing the treatment and correction options for surgeons performing anterior spinal surgery. Axis’s proprietary platform technology of modular cages provides the most comprehensive spinal correction capabilities available to date.

Axis has developed products which address the key anterior surgical approaches; ALIF, OLIF and Lateral. The company has also created an advanced Retractor system to improve the safety and reproducibility of anterior surgery. The first device to market, the Axis-ALIF was cleared by the FDA in May 2020 and the first surgery was completed in Atlanta, USA in November 2020.

More information can be found at www.axisspinetech.com.

About ACF Investors

Launched in 2011, ACF Investors (formerly the Angel CoFund) is a privately managed and commercially focused institution that works alongside groups of business angels to invest in high potential SMEs across the UK, directly providing funding as well as encouraging the expansion and development of the business angel market.

To date the ACF Investors has supported close to 100 companies (for example Ebury, Gousto, Creo Medical and Form3) providing more than £50 million in direct investment alongside more than £300m from business angels and other investors, making it one of the most active early-stage investors in the country. ACF Investors is a long-term investor and, in aggregate, sets aside £1 of further capital for every £1 it invests. This model gives portfolio companies and co-investors the support they need to propel strong growth.

To find out more, please visit www.acfinvestors.com

About Mercia Asset Management PLC:

Mercia is a proactive, specialist asset manager focused on supporting regional SMEs to achieve their growth aspirations. Mercia provides capital across its four asset classes of balance sheet, venture, private equity and debt capital: the Group’s ‘Complete Connected Capital’. The Group initially nurtures businesses via its third-party funds under management, then over time Mercia can provide further funding to the most promising companies, by deploying direct investment follow-on capital from its own balance sheet.

The Group has a strong UK footprint through its regional offices, 19 university partnerships and extensive personal networks, providing it with access to high-quality deal flow. Mercia currently has c.£872million of assets under management and, since its IPO in December 2014, has invested c.£106million into its direct investment portfolio.

Mercia Asset Management PLC is quoted on AIM with the EPIC “MERC”.