NEW ORLEANS, July 22, 2021 /PRNewswire/ — LongueVue Capital (“LVC”), a New Orleans-based private equity firm, is pleased to announce the sale of Zavation Medical Products (“Zavation” or the “Company”) to an affiliate of Gemspring Capital Management, a Westport, Connecticut-based private equity firm.

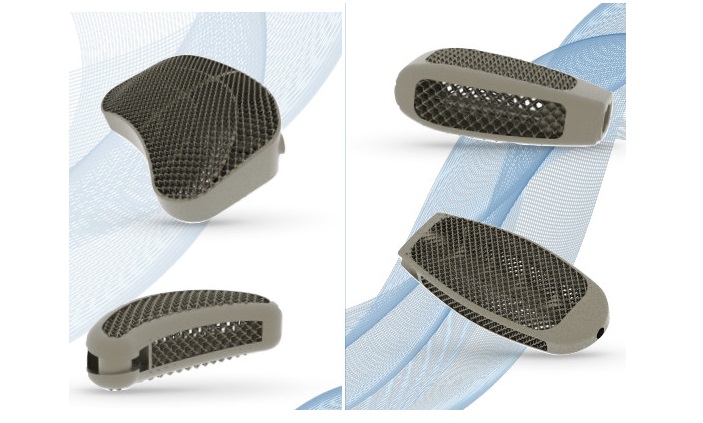

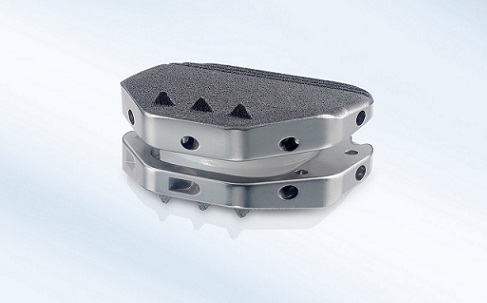

Headquartered in Flowood, MS, Zavation is a leading designer and manufacturer of spinal implants, instruments, minimally invasive surgical offerings, interventional spine products, and biologics. Since its founding in 2011, Zavation has built an industry-leading reputation driven by its innovative product line, exceptional customer service, commitment to quality, and state-of-the-art manufacturing facilities.

LVC partnered with Zavation’s CEO, Jeffrey Johnson, and its management team to acquire the Company in 2017. As Zavation’s first institutional investor, LVC provided significant growth capital to professionalize the business and invest in new product development, infrastructure, operational enhancements, and human capital. These investments in growth allowed Zavation to expand its manufacturing capacity and double its employee base; meaningfully grow its market share and distributors; launch 21 unique products; more than double its revenues; and complete the acquisition of Pan Medical US Corp., whose complementary and patented technology expanded the Company’s penetration in the interventional spine market. As a result of the Company’s continued success, Zavation was named to the 2020 Inc. 5000 Fastest Growing Private Companies, recognized as a top place to work by the Mississippi Business Journal, and named a 2020 Top Medical Device Solution Provider by Med Tech Outlook.

“Jeffrey and the Zavation management team have been incredible partners, and Zavation’s success is a direct result of Jeffrey’s vision and the Zavation team’s ability to execute. Zavation has realized transformative growth in a relatively short period of time, rendering it a truly world-class medical device company,” commented Ryan Nagim, LVC Partner leading the transaction.

Rick Rees, LVC’s Co-Founder and Managing Partner, added, “Jeffrey and the Zavation team are a perfect example of how growth and value can be unlocked through LVC’s partnership approach of empowering entrepreneurs with infrastructure, expertise, and capital. We’ve enjoyed developing lasting relationships with the team and are excited to watch Zavation’s continued success with its new partners, Gemspring Capital Management.”

“LongueVue Capital has been a fantastic partner, and the LVC team was always a proactive resource as we explored new opportunities and worked through challenges,” said Jeffrey Johnson, Founder & Chief Executive Officer of Zavation. He added, “LVC’s experience growing healthcare, medical device, and manufacturing businesses—coupled with their commitment to providing the capital and resources we needed to reach our strategic goals—made them the ideal private equity partner for Zavation over the past four years.”

This transaction spanned both LVC II and LVC III and marks the firm’s seventh exit for LVC II and second exit for LVC III (2017 vintage fund). Since closing LVC III, the team has completed nine platform investments and six add-on investments of entrepreneur-backed, high-growth businesses across a variety of sectors. As an opportunistic and flexible source of capital focused on value-added partnerships, LVC utilizes its financial and industry-specific expertise, as well as its experienced team of operating partners, to drive growth and profitability within its portfolio companies. LVC remains focused on targeting investments within its key sectors: healthcare and life sciences, food and beverage, specialty packaging, transportation & logistics, consumer, industrial services, and niche manufacturing. In addition to Zavation, LVC has invested in five other healthcare platforms, with healthcare representing LVC’s largest investment vertical.

Operating Partner Pete Allen and Vice President Austin Rees worked alongside Ryan Nagim on the Zavation investment. Moelis & Company, led by Jon Hammack and Chris Foss, represented Zavation as the exclusive financial advisor. Norton Rose Fulbright served as legal counsel to Zavation.

SOURCE LongueVue Capital

Related Links https://www.lvcpartners.com/